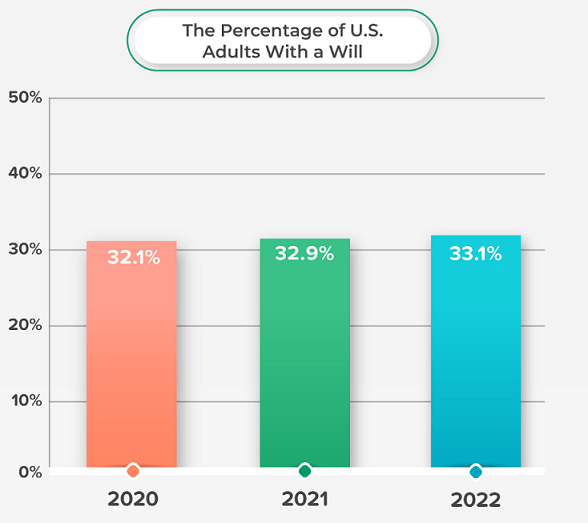

More than 50 percent of Americans find estate planning important, yet statistics show only about 33 percent have a will.

Those individuals with a will may have moved to a different state or forgot to update their will after life events such as marriage, divorce, births, and deaths, making it ineffective. One of the ways to ensure your will remains valid is to review its contents regularly with your estate planning attorney so that it complies with your state laws and reflects your family situation.

Dying Without a Will

If a will doesn’t meet the state’s legal requirements, it isn’t valid, which is the same as not having a will. Intestate is the legal term describing a person who dies without a will or a valid will. When this happens, determining asset distribution becomes the responsibility of the state probate court. States will follow their current intestacy law, which may not reflect the decedent’s wishes.

The probate court names an administrator to compile a list of assets, pay debts, and address any state and federal taxes that must be paid by the estate.

Then the appointed administrator establishes a hierarchy of inheritors, usually beginning with spouses followed by other close relatives being first in line to receive the decedent’s assets. A court-appointed administrator charges a fee from the decedent’s estate for their services.

The Function of a Valid Will

A will is the most common type of estate planning document. Upon your death, it accomplishes several different things:

- Designating a personal representative (executor)

- Arranging to pay outstanding debts and taxes via the estate

- Naming and dividing property among heirs

- Establishing guardianship for minor children

When creating their will, many individuals will add advanced directives, trusts, and other documents for a more comprehensive estate plan to manage assets if they are ill, injured, or unable to communicate their wishes.

Legal requirements for writing a will may differ among states but include being 18 years old, having “capacity” or being of sound mind, signing the document, and having two adult witnesses who also provide signatures.

Community Property States, Common Law States, and the Unmarried

Surviving spouses in a community property state are considered joint owners of any maritally acquired property and entitled to at minimum half of the decedent's estate. However, depending on the court's determination, they can receive less or more than half or even the entire estate if there are no surviving children or grandchildren.

As of 2022, there are seven common law marriage states plus Washington, DC. Some states will only recognize common law marriages in relationships formed before a certain date. Additionally, some states that don't permit common law marriage still recognize this marriage type contracted from other states. Speaking with an estate planning attorney to determine your legal status is important.

If you're in a relationship without legal marital status, the easiest way to provide for your partner is through joint tenants with right of survivorship accounts (JTWROS) and payable-on-death accounts (POD). These accounts will pass directly to the named beneficiary outside of a will, and the probate process.

Types of Wills

The form and structure of a will may vary:

- Simple Will – This will names an executor to carry out your obligations, funeral and burial arrangements, and guardianship for minor children.

- Joint Will – Some married couples have one set of wishes. Some states don’t recognize joint wills, and most lawyers discourage their clients from using them.

- Holographic Will – A handwritten, un-witnessed will that is only legal in some states and typically only created in emergencies where witnesses are unavailable.

- Pour-over Will – This type of will accompanies a living trust and captures any property unintentionally left out of the living trust as a safety mechanism.

- Electronic Will – Some states permit remote electronically generated, signed, and stored wills.

- Testamentary Trust – This trust is part of a will and goes into effect after the decedent’s probate process is complete.

- Nuncupative Will - An oral or verbal will used when a person is too sick to execute a written will. This type of will is not legal in most jurisdictions.

Each of these wills is a variation of a last will and testament and leaves instructions to follow after your death. A living will is not a last will and works differently. It outlines preferences about future healthcare treatments while you are alive and unable to communicate your wishes to loved ones or doctors.

Ensure Your Will is Legal

Laws concerning wills vary by state, and knowing your state’s requirements is crucial to create a valid will. Conducting online research and creating your own will can be risky and may not meet your state’s specific laws and regulations. An experienced estate planning attorney can assess your situation and determine what type of will best suits your needs. They provide you with the original will and a copy of the document to store in a safe location. Let your loved ones know where you keep your will and other associated documents.

Review and Update Your Will

You can change, update, or revoke your will at any time if you are of sound mind. Planning to revisit the document annually is a good practice, as major life events create the need to make changes more frequently than you think. If the probate court finds your will invalid, state intestacy laws take over.

If you want to change your will, schedule a consultation with our estate planning lawyers to maintain your will’s validity and see if any changes to state law will affect your decisions.

more news you can use

Still have questions?