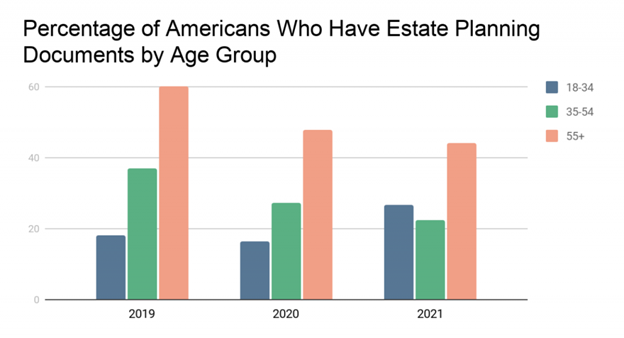

A 2021 Wills and Estate Planning Study of 2,400 Americans by Caring.com with YouGov finds the percentage of seniors aged 55 and older who have created a will has decreased from 60 to 44 percent since 2019. This decrease is surprising considering the increase of younger adults who now are 63 percent more likely to have a will. The study concludes that despite the COVID-19 pandemic, the overall prevalence of estate planning is considerably lower, especially for seniors, than in previous years.

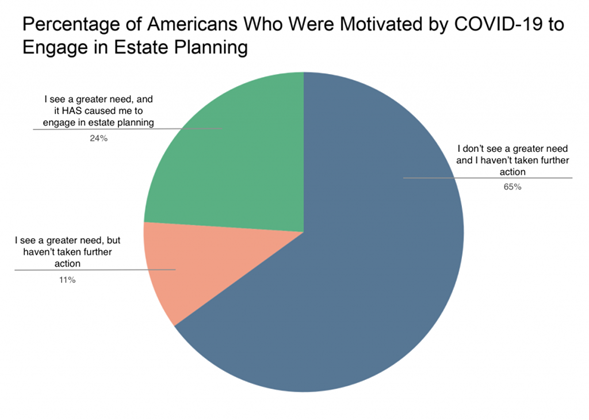

While seniors and near seniors have seen an increase in the need to create a will, there is little follow-through on creating them. Two out of three Americans don’t have crucial estate planning documents.

Somewhat surprisingly, the report finds that because of the COVID-19 pandemic, younger adults are more likely to engage in the estate planning process than older generations. They were more likely to follow through with a will and other legal documents.

Reasons Seniors Don’t Have a Will

The study cites four main reasons seniors and near seniors don't have a will and other related estate planning documents. More than 35 percent say they just haven't gotten around to it, and just under 35 percent state they don't have enough assets to leave to anyone. The other two reasons involve not knowing how to get a will or an estate plan in place or believing it's too expensive. Despite most people agreeing that having a will by the age of 35 is important, these procrastinations and misunderstandings mean that almost two-thirds of Americans haven't prepared their families for medical or financial emergencies.

Since COVID-19, law offices across the country have pivoted to virtual meetings and can even accept verified e-signatures in many circumstances. Creating these legal documents can be simple and cost-effective. Getting started may be uncomfortable because no one particularly likes thinking about their mortality; however, you'll likely experience peace of mind when finished. If you have a spouse and family, they will be relieved to know specific issues and intentions are legally addressed.

Three Main Estate Planning Documents

Wills

A will is the most common type of estate planning document and dictates several things. It will name a personal representative (executor) to handle the estate, property division, debts, taxes, and guardianships. For some, a will may be all that is needed. However, additional documents, such as a trust, may be necessary for individuals with more extensive assets or fears of family disputes impacting the will. Dying without a valid will is known as dying “intestate,” and states have laws about how to proceed. The estate’s assets are frozen while the court assesses details and applies state laws to disperse the deceased’s possessions. This process can be exhausting and time-consuming for the surviving family. Additionally, a percentage of your estate will pay probate fees, ranging from three to eight percent of the total estate value.

Advance Healthcare Directives

This document stipulates your desires regarding end-of-life care or what will happen if you become incapacitated and unable to make decisions for yourself. It also names a medical power of attorney or health care proxy to act on your behalf. Advanced directives take effect during your lifetime, unlike a will which is only enacted on death. Despite the importance of outlining your wishes for care, the survey finds one in five people (eighteen percent) don't know about advanced healthcare directives. This directive can guide medical professionals and your family in medical emergencies when you can't communicate. In this age of medical technology that can sustain life more readily, an advanced directive relieves pressure on your family members when it comes time to make difficult decisions such as life support.

Trusts

A trust is helpful for several reasons. It provides more comprehensive protection than a will for individuals with larger estates, more significant amounts of property, or expectations of a disability. Like an advance healthcare directive, a living trust takes effect upon its creation. As the trust grantor, you will put the desired property in the trust and establish a successor trustee(s). Most living trusts are revocable during your lifetime (meaning you may amend the trust document or what is in the trust) and become irrevocable upon your death. Generally, there are tax and inheritance benefits to having a trust, and the document is not a public record; therefore, your successor trustee can manage your estate privately.

Estate planning documents are more accessible than ever to create and implement in this digital age. By breaking up the process into smaller steps and answering some basic questions, your estate plan shouldn't be an overwhelming process. Think things through, talk over the details with your loved ones, and then contact Rochester Elder Law to schedule a consultation with a qualified estate planning attorney. This very achievable goal is more important than ever and easier than you think.

more news you can use

Still have questions?